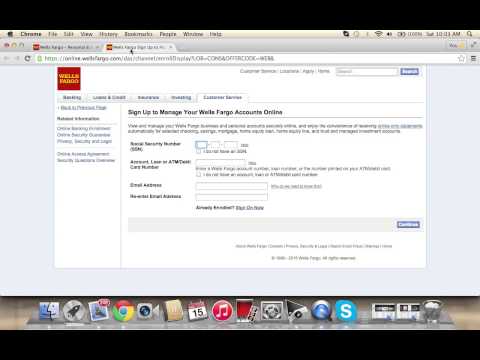

Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. The Request feature within Zelle® is only available through Wells Fargo using a smartphone. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®.

To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. In recent years, the bank has sought to distinguish itself in the marketplace as a leader in "cross selling" these products and services to existing customers who did not already have them. When cross selling is based on efforts to generate more business from existing customers based on strong customer satisfaction and excellent customer service, it is a common and accepted business practice.

The CEO portal offers Wells Fargo commercial and corporate customers single sign-on access to more than 80 online banking applications and reports. The CEO Mobile service is an extension of select portal services, giving customers the ability to access accounts and make important decisions when they're on the move. Both are types of savings products that banks and credit unions offer.

Both are considered safe, as long as they're insured by the FDIC at banks or the NCUSIF at credit unions. Savers opening a CD or money market account might have to meet higher minimum deposit requirements than they would with a savings account. Wells Fargo also touts the use of your Way2Save account as a method of overdraft protection for customers who also have checking accounts. If you sign up for this optional service, Wells Fargo will transfer money from your Way2Save account into your checking account to cover an overdraft. However, this service doesn't prevent you from being charged a $12.50 overdraft fee once per business day.

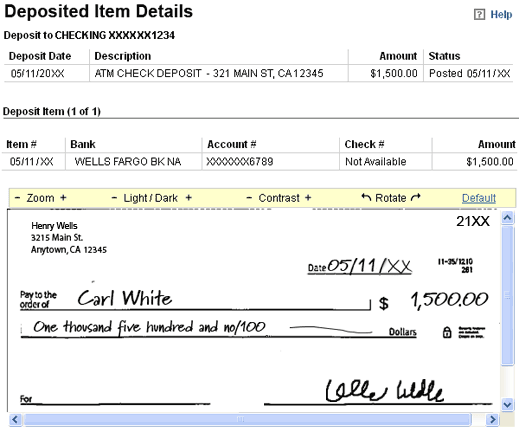

The fee can be avoided if a covering transfer or deposit is made on the same business day. Therefore, online-bank customers tend to rely heavily on mobile banking and mobile check deposits to manage their accounts and deposit checks. Mobile deposit lets you submit photos of the front and back of your endorsed check. You can save time with fewer trips to a Wells Fargo ATM or branch. Mobile deposit is only available through the Wells Fargo Mobile® app.

Availability may be affected by your mobile carrier's coverage area. See Wells Fargo's Online Access Agreement for other terms, conditions, and limitations. CDs at either a FDIC-insured bank or at a credit union regulated by the NCUA and insured by the NCUSIF are safe as long as it's within insurance guidelines.

These accounts are safe at online banks, brick-and-mortar banks and credit unions because they're backed by the full faith and credit of the U.S. government. The standard insurance limit is $250,000 per depositor, per insured bank, for each account ownership category at an FDIC-insured bank. For federally insured credit unions, the standard share insurance is $250,000 per share owner, per insured credit union, for each account ownership category. More convenient than cash and checks — money is deducted right from your business checking account.

Make deposits and withdrawals at the ATM with yourbusiness debit card. BOCA RATON, FL (BocaNewsNow.com) — While not a universal move, Wells Fargo seems to be raising the mobile deposit limits for business and personal customers of the bank who deposit checks using an app. The move, apparently, is reduce the need to rely on an ATM to conduct business during the COVID-19 crisis. We add your direct deposit amount to your Available Balance on the same day we receive your deposit. The Available Balance is the most current record we have about the funds that are available for withdrawal from your account. This balance may not reflect all of your transactions, such as checks you have written or debit card transactions that have been approved but not yet submitted for payment by the merchant.

You can typically earn a higher APY with a CD than most savings accounts or money market accounts. That interest is usually compounded on a daily, monthly, quarterly or annual basis. It is usually credited to your account on a monthly, quarterly, semiannual or annual basis.

You usually have a grace period between the CD's maturity date and renewal date. This allows you to renew it, change the terms or withdraw and close it. In most cases, can withdraw from a CD at any time, but this may result in an early withdrawal penalty. A CD, or certificate of deposit, is a type of savings account found at banks and credit unions that pays a fixed interest rate on money deposited. In exchange, you agree to keep the full deposit in the account for a set term.

Common terms include three, six, nine, 12, 18, 24, 36, 48 and 60 months. A CD is a type of savings account that has a fixed rate and a maturity date. Typically, the rate on a CD is higher because you must keep your funds in your CD account for the specified duration or term of the CD. As long as you abide by the set rules, such as minimum deposits and keeping your funds locked in your account until the maturity date, you can lock in your CD rate and not have to worry about changing rates. Be careful not to withdraw your money before maturity, as you can be hit with an early withdrawal penalty. Read more below on CD FAQs as well as details on the best CD rates.

Note that many online banks will accept check deposits through the mail if you ever exceed their mobile check deposit limits. Availability may be affected by your mobile carrier's coverage area. See Wells Fargo's Online Access Agreementfor other terms, conditions, and limitations. When you deposit a paper check at a branch or an ATM, we credit the deposit to your account on that same business day if the deposit is made before the displayed cut-off time.

Each check deposit is evaluated to determine if the bank can make all or a portion of your check immediately available for your use. There are a number of factors that determine whether a deposit receives immediate funds availability. Typically, any funds that are not made available to you immediately are credited to your account during our next nightly processing and available for your use the following day.

We typically process transactions Monday through Friday, excluding holidays. If you're interested in a safe alternative to a CD, you have a few options. Money market accounts and savings accounts, for example, are interest-bearing deposit accounts that can be found at banks and credit unions. Although those accounts typically don't offer rates as high as CDs, they provide more liquidity.

Savings and money market accounts are more liquid than CDs. That means the funds you store in those types of accounts are easier to access and have fewer withdrawal penalties and limitations. This makes savings accounts better for your emergency fund. You could withdraw the savings you've stashed in a CD, but be prepared to pay a penalty if you take your money out before the CD's maturity date (unless you've purchased a no-penalty CD). Whether you should open a CD for your child depends on when the money is going to be used.

If you won't need the money for a set amount of time, a CD could be a great way to grow your child's savings. If the goal is to earn a fixed APY, that would also be a reason to consider a CD. However, if this is money that you're looking to gain a potentially higher rate of return, you may want to look at investment options.

If it's unclear when your child might need the money, consider a savings account or money market account. If you withdraw the money before the maturity date, you generally will have to pay a penalty fee. The Federal Reserve's interest rate decisions can impact the rates that banks offer on CDs.

When the Fed raises or lowers the federal funds rate, banks typically respond by moving savings and money market account yields in the same direction. In 2019, a year when the Fed lowered rates three times, CDs generally decreased before or after a Fed rate cut. Bankrate's editorial team regularly updates rates featured on this page around every two weeks. We look mainly for the highest APYs and break ties using the minimum balance to open a CD. Bankrate's editorial team has reviewed nearly all of the banks and credit unions that it tracks here. Bankrate researches rates for more than 70 widely available banks and popular credit unions on a weekly basis.

These banks were selected either because they offer competitive APYs, they're larger-sized institutions with a well-known brand , internet search popularity and/or other factors. These banks tend to have widely available accounts and the credit unions are some of the largest or most popular credit unions in the U.S. And make sure your money is within insurance limits and guidelines. To thoroughly understand both methods of check deposits and determine which is best for your business, it's important to speak to a banker. Customer's may be able to apply for either service online in conjunction with an existing checking account, but a conversation will avoid misunderstandings around how the services work at a specific bank. Money from a check deposited remotely can often be processed faster than a paper check, and customers can easily track scanned checks and deposit history online.

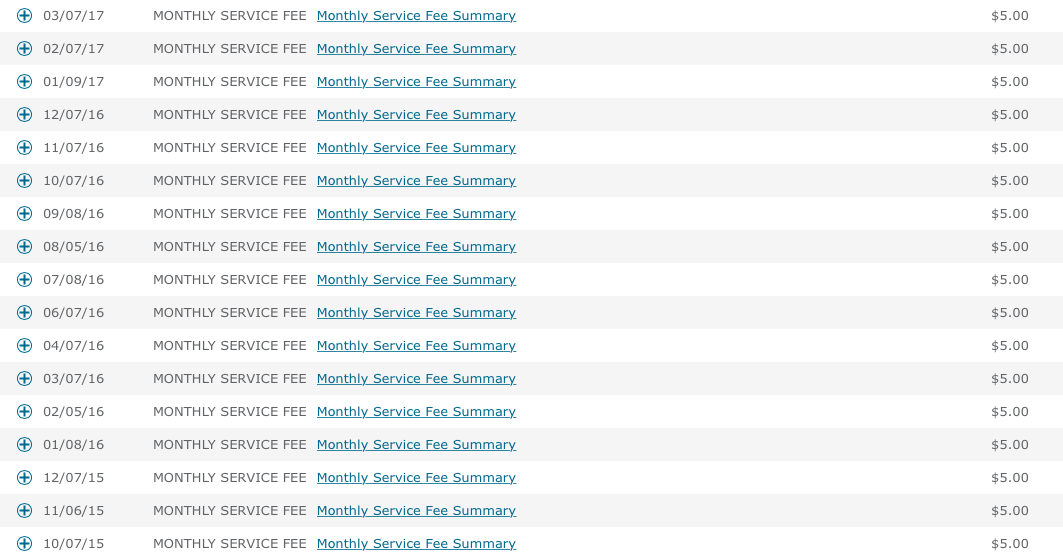

Whether the money is deposited the same day or must clear the other party's bank first may depend on the type of checking account, and is subject to that specific bank's policies and procedures. Be sure to ask questions so you understand how remote deposit works for your checking account. Another savings encouragement is the Save As You Go® transfer, which moves $1 from your Wells Fargo checking account to your Way2Save account with each qualifying transaction. These transactions include any non-recurring debit card purchases and any time you pay a bill using the Wells Fargo online bill pay option. The other drawback is the monthly limit for mobile check deposit too low.

I have have paychecks once every two weeks, I have to deposit my second check to my other bank account due to the limit. The withdraw and deposit amount not quite easily distinguishable. I wish the withdrawals can have negative sign at the front just like the deposit with positive sign. However, money market accounts offer more liquidity than CDs, often providing the ability to write a limited number of checks per month directly out of the account.

Those liquidity features aren't something you'll find with CDs. With a certificate of deposit , you deposit money for a predetermined amount of time and earn interest on those funds. The interest is usually compounded and added to the principal. One of the reasons you get a higher annual percentage yield is because the bank knows how long you'll be keeping your money in the CD. The bank also factors in for the risk of early withdrawals by imposing a fee if you access your money before the CD term ends. CDs are popular accounts for longer-term money with capital preservation as the main goal.

CDs are best for individuals looking for a guaranteed rate of return that’s typically higher than a savings account. In exchange for a higher rate, funds are tied up for a set period of time and early withdrawal penalties may apply. Federal law permits limiting certain types of withdrawals and transfers from savings and money market accounts to a combined total of 6 per statement cycle. In addition, Wells Fargo automatically waives the monthly fee for account holders under the age of 24. On Thursday, the bank said its ATM services had been restored and its mobile and online systems were working, although not all features were functional. For instance, it said consumer credit card and mortgage balance weren't yet working.

The company blamed a "contained issue" at one data center, and said it wasn't a cybersecurity issue. Luckily, many online banks understand this concern and offer higher mobile deposit limits compared to banks that have a physical presence. Available balance is the most current record we have about the funds that are available for your use or withdrawal.

It includes all deposits and withdrawals that have been posted to your account, then adjusts for any holds on recent deposits and any pending transactions that are known to the bank. Wells Fargo Online and Wells Fargo Business Online® customers who maintain an eligible checking or savings account are eligible to use mobile deposit. On a second regulatory matter, Wells Fargo said late Thursday a 2016 consent order from the Consumer Financial Protection Bureau, or CFPB, regarding its retail sales practices has expired. Non-APY comparison conducted by an independent research firm and based on data compiled in May 2021 from company websites, customer service agents, and consumer savings account offers. In some cases, competitors assess and/or waive fees if certain criteria are met. Investors have a lot to consider when deciding between a CD and a bond.

CDs are safe investments that typically pay a fixed interest rate. You're also guaranteed to receive that amount of interest for the term and get your full principal amount back, as long as you don't make any premature withdrawals. "They're really only appropriate for short-term needs, simply because they are too low. The rates of return are too low," says Mari Adam, president and founder of Adam Financial Associates Inc. If you've historically kept a lot of your money in a savings account, now could be a good opportunity to lock in your CD rate. While some banks are offering savings yields that are currently higher than what you can receive on a CD, it's a good bet that the rates on savings accounts will continue to decline.

Some banks and credit unions, however, offer "specialty" CDs that give you more flexibility. One such CD is a no-penalty account, which gives you the option to withdraw money early without incurring a penalty. The interest rate paid on no-penalty CDs, and similar types of specialty CDs, is typically lower than a traditional CD. If you're looking for a fixed annual percentage yield but aren't sure when you'll need to access some of your money, a no-penalty CD can be a good compromise.

It may give you a higher yield than a savings account or money market account. As the bank's premium checking account, Portfolio by Wells Fargo offers customers a number of major perks. At its core, the Portfolio account is an interest-bearing checking account, although the 0.01% APY is not currently impressive. Expect a $25 per month maintenance fee, unless you maintain a minimum of $20,000 in your linked accounts at the end of each statement period.

Online Banking and Mobile Banking offer convenient methods to access your Wells Bank accounts. You can perform a variety of banking services online, whether by computer or other internet device. These free services include account information inquiry, statement retrieval, online transfers between accounts, online viewing of transactions and images of your checks, and online bill pay.

Customers who have several accounts with the bank and maintain larger balances could be eligible for higher mobile deposit limits. The Capital One mobile check deposit limit varies for each customer account. According to Capital One branch banker, the typical limit is $5,000 per day.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.