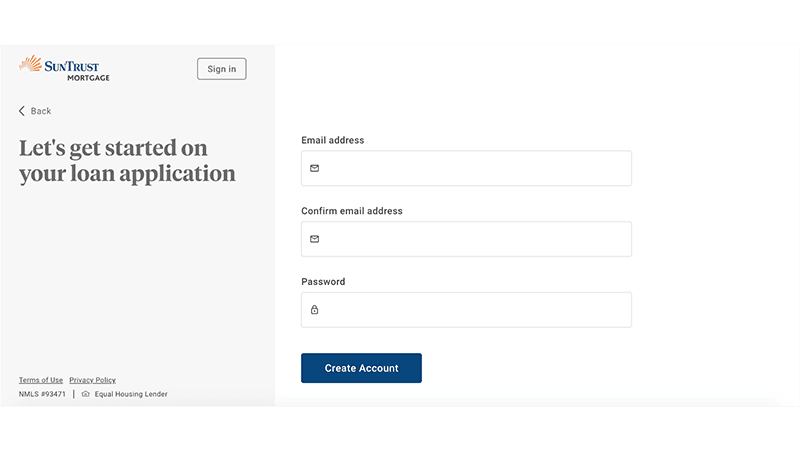

The settlement will likely provide direct benefits to borrowers far in excess of $500 million because SunTrust will not be permitted to claim credit for every dollar spent on the required consumer relief. SunTrust has also agreed to pay $50 million in cash to redress its servicing practices, $40 million of which will be distributed to borrowers and homeowners through the Borrower Payment Fund established by the NMS and administered by the states. Finally, SunTrust agreed to pay $50 million in cash to redress abusive servicing practices, $40 million of which will be distributed to borrowers who lost their homes to foreclosure. To qualify, the borrower must submit a HAMP application and all required documentation to the mortgage servicer. The servicer must then review the paperwork to determine if the borrower satisfies the prescribed income-to-housing debt ratio and other requirements. If a qualified borrower makes his modified mortgage payment for each of the trial period months, the servicer must make the modification permanent.

The new servicing standards ensure that foreclosure is a last resort by requiring SunTrust to evaluate homeowners for other loss mitigation options first. In addition, SunTrust is restricted from foreclosing while the homeowner is being considered for a loan modification. The new standards also include procedures and timelines for reviewing loan modification applications and give homeowners the right to appeal denials. SunTrust will also be required to simplify the process for homeowners needing help by creating a single point of contact for borrowers seeking information about their loans and—importantly—maintaining adequate staff to handle calls. This settlement fund provides Floridians who lost their homes some financial relief for mortgage servicing and foreclosure abuses.

Borrowers should expect a package including a cover letter, claim form and instructions this week. Eligible claimants will receive a minimum of $850 for each loan, and payment checks should be mailed starting in the fall of 2015. I strongly encourage eligible Floridians to submit claim forms by the June 4 deadline. For additional questions or assistance please visit NationalMortgageSettlement.com. This week, Florida borrowers who received mortgaging services from SunTrust Mortgage, Inc. began receiving claim forms for refunds.

More than 8,000 Floridians, who used SunTrust Mortgage and lost their homes to foreclosure between Jan. 1, 2008 and Dec. 31, 2013, are eligible for a payment under the National SunTrust Settlement. In July 2014, my office along with 48 other attorneys general, the District of Columbia, the U.S. Department of Housing and Urban Development, and the Consumer Financial Protection Bureau reached a $550 million national settlement with SunTrust to resolve allegations of mortgage origination, servicing and foreclosure abuses. SunTrust foreclosed more than 45,000 homes during the five-year period covered by the settlement. Approximately $39 million of the settlement money will be used for payments to borrowers nationwide, with more than $6.5 million expected to go directly to eligible Floridians.

The $500 million in nationwide borrower relief parallels the assistance that five major banks agreed to provide their troubled customers in the well-publicized $25-billion national mortgage settlement reached in 2012. Components include loan modifications, such as reductions in principal, and short sales, in which borrowers are freed from mortgage debt by selling their homes for less than what they owe. The $500 million in borrower relief parallels the assistance that five major banks agreed to provide their troubled customers in the well-publicized $25-billion national mortgage settlement reached in 2012.

When the trial periods lasted beyond the stated three- or four-month periods, however, alternative options evaporated. In many parts of the country, home values plummeted over the course of 2009 and 2010. Renting or selling one's home was often no longer an alternative, or at best, resulted in a lower sale price or rental income. Because the borrower's trial payment was almost always less than a full contractual payment under the borrower's original mortgage, by participating in a trial period plan, a borrower was immediately delinquent under the terms of his original mortgage.

The longer a borrower was in a trial period, the more the borrower became delinquent on his original mortgage. It thus became increasingly difficult for borrowers who were ultimately rejected from HAMP to qualify for alternative loan modifications as the arrearage grew larger. The practical result was that many borrowers had limited, if any, loss mitigation options after a HAMP denial. The three-year settlement provides direct payments to eligible New Jersey borrowers for past foreclosure abuses, the news release said. It also provides for loan modifications and other relief to borrowers in need of assistance, imposes tough new mortgage servicing standards on Sun Trust, and grants oversight authority to an independent monitor. Allowing servicers to offer borrowers additional loss mitigation options that are typically only enacted to address natural disasters.

This includes loan modifications that give servicers options to provide payment relief or keep the payment the same post the forbearance period. This civil law enforcement action also alleged that the servicers committed widespread errors and abuses in their foreclosure processes. Broad reform of the mortgage servicing process resulted from the settlement, as well as financial relief for borrowers still in their homes through direct loan modification relief, including principal reduction. The three-year settlement provides direct payments to Iowa borrowers for past foreclosure abuses, loan modifications and other relief for borrowers in need of assistance, tough new mortgage servicing standards, and grants oversight authority to an independent monitor. The three-year settlement with 49 other states, the District of Columbia, U.S. Department of Justice and the U.S. The three-year settlement with Utah's Division of Consumer Protection and 48 other states, the District of Columbia, the U.S.

Under the agreement, SunTrust must provide certain Washington state borrowers with loan modifications or other relief. SunTrust will choose from an extensive list of options, including principal reductions and refinancing for underwater mortgages. While SunTrust decides how many loans and which loans to modify, the company must meet certain minimum targets. Because SunTrust receives only partial settlement credit for many types of loan modifications, the settlement is expected to provide relief to borrowers that will exceed the overall minimum amount. The three-year agreement provides $3 million in direct payments to Washington borrowers for past foreclosure abuses, loan modifications and other relief for borrowers in need of assistance.

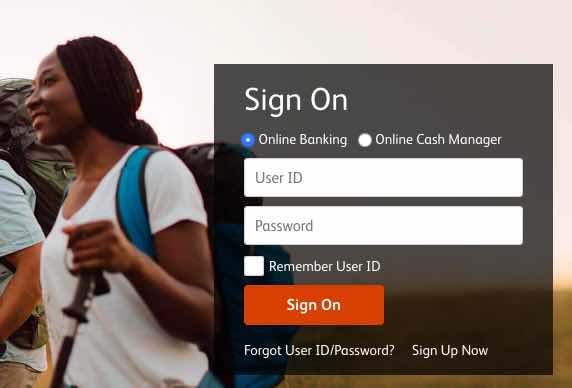

It also includes tough new mortgage servicing standards and grants oversight authority to an independent monitor. SunTrust doesn't disclose where its services are available on its website. If you're interested in its mortgages, contact a representative to see if it services your area.Does SunTrust offer refinancing? SunTrust offers interest rate reduction refinancing for veterans and cash-out refinancing.Does SunTrust sell its loans? The SunTrust site doesn't mention whether or not it sells its loans.What mortgage payment options does SunTrust offer? SunTrust offers a few payment options, including one-time payments, SurePay recurring payments and biweekly mortgage plans.

The joint federal-state agreement also requires SunTrust to implement significant changes in how they service mortgage loans, handle foreclosures, and ensure the accuracy of information provided in federal bankruptcy court. The agreement requires new servicing standards which will prevent foreclosure abuses of the past, such as robo-signing, improper documentation and lost paperwork, and create dozens of new consumer protections. The new standards provide for strict oversight of foreclosure processing, including third-party vendors, and new requirements to undertake pre-filing reviews of certain documents filed in bankruptcy court. Citizens Bank is offering mortgage payment assistance for up to 90 days with no late fees.

The bank won't report late or missed payments to credit bureau agencies for mortgages or any other products. The agreement requires SunTrust to provide certain Iowa borrowers with loan modifications or other relief. The modifications, which SunTrust chooses through an extensive list of options, include principal reductions and refinancing for underwater mortgages. SunTrust decides how many loans and which loans to modify, but must meet certain minimum targets.

Because SunTrust receives only partial settlement credit for many types of loan modifications, the settlement will provide relief to borrowers that will exceed the overall minimum amount. The settlement requires SunTrust to provide New Jersey borrowers loan modifications or other consumer relief which, at this time, is estimated to total approximately $6.5 million. The loan modifications, which SunTrust will choose through an extensive list of options, include principal reductions and refinancing for underwater mortgages. SunTrust will decide how many loans and which loans to modify, but must meet certain minimum targets. The borrower payment amount will depend on how many eligible borrowers file claims.

The agreement requires SunTrust to provide South Dakota borrowers an estimated $174,137 worth of loan modifications or other relief. The agreement also includes $40 million for a national fund for eligible borrowers who encountered servicing abuses by SunTrust and lost their homes to foreclosure between Jan. 1, 2008 and Dec. 31, 2013. Washington borrowers with loans serviced by SunTrust will be eligible for a payment from the fund. Their payment amount will depend on how many borrowers file claims. Eligible borrowers will be contacted about how to qualify for payments. The agreement requires SunTrust to provide certain Georgia borrowers with loan modifications or other relief.

All of these deficiencies resulted in a significant backlog of borrowers who were waiting on a decision from SunTrust as to whether they qualified for HAMP. Because SunTrust's HAMP program was under-resourced and under-funded, the backlog grew only deeper. Month after month, SunTrust had a backlog of tens of thousands of borrowers waiting to apply for HAMP, waiting for SunTrust to send a trial period agreement, or waiting to hear whether they qualified for their much-needed mortgage relief. For example, SunTrust understood that its negotiators should have no more than 250 loan modification applications in each of their queues, but in the spring of 2010, some SunTrust negotiators had upwards of 3,000 files in each of their queues. These mass solicitations consisted of a standard cover letter and several attachments, as well as a trial period plan agreement (collectively "the HAMP Package"). The trial period plan gave the borrower an estimated modified mortgage payment and a three- or four-month trial plan schedule with due dates for making the new mortgage payments.

The HAMP Packages touted why SunTrust customers should apply for HAMP and encouraged them to do so as quickly as possible. The company that you make your monthly payment to is your mortgage servicer. A mortgage servicer administers mortgage loans, including collecting and recording payments from borrowers. A servicer also handles loan defaults and foreclosures, and may offer programs to avoid foreclosure and to help homeowners who are behind on their payments.

A loan modification restructures an existing loan's terms to help the borrower retain their home despite financial difficulties, including alternative ways to repay the amounts suspended during the forbearance period. There are different considerations for each borrower to assess, and multiple types of loan modifications. Criteria such as loan type and/or account status will determine what modification options are available to each individual borrower. Under the FHFA's coronavirus relief plan, your servicer is required to work with you on a mortgage modification by the time your forbearance period is over so that you can afford your new monthly payments.

It also must suspend foreclosures and evictions through at least mid-May. The agreement's mortgage servicing terms largely emulates the 2012 National Mortgage Settlement reached in February 2012 between the federal government, 49 state attorneys general, including Utah, and the five largest national mortgage servicers. That agreement has provided consumers nationwide with more than $55 billion in direct relief, created tough new servicing standards, and implemented independent oversight. The servicing terms in the SunTrust agreement are modeled after the 2012 National Mortgage Settlement reached in February 2012 between the federal government, 49 state attorneys general, including Washington's, and the five largest national mortgage servicers. The NMS has provided consumers nationwide with more than $50 billion in direct relief, created strong new servicing standards, and required independent oversight. That settlement has provided over $2.4 billion in direct relief to Illinois homeowners.

The agreement's mortgage servicing terms largely mirrors the 2012 National Mortgage Settlement reached in February 2012 between the federal government, 49 state attorneys general, including Georgia, and the five largest national mortgage servicers. That agreement has provided consumers nationwide with more than $50 billion in direct relief, created heightened servicing standards, and implemented independent oversight. Borrowers were regularly on trial periods for close to, if not more than, a year.

When borrowers agreed to enter a trial period plan, they forewent other potential options for saving or disposing of their home. SunTrust's deficiencies in administering HAMP went beyond extended trial periods. With inadequate staffing, training, and processes in place, SunTrust failed to fulfill several other Statements it made in the HAMP Packages. SunTrust misreported current borrowers as delinquent to the credit bureaus. It also mishandled borrowers' trial period payments, leaving the payments in custodial suspense accounts instead of posting them to the mortgage loan, thus making the borrower appear more delinquent than the borrower actually was. SunTrust also improperly made collection demands on, and in some cases commenced foreclosure proceedings against, borrowers who were on extended HAMP trials.

SunTrust mass denied other borrowers from HAMP without reviewing their applications. In yet other cases, SunTrust gave some borrowers who should have received a HAMP modification an alternative modification that was less favorable to the borrower. SunTrust also provided false and inaccurate information regarding some of its HAMP denials to the Treasury Department through the IR2 reporting system. The guidelines also provide specific instructions on how the servicer must communicate with borrowers about their applications, the qualifying process, and the trial period. As a general matter, the servicer must provide borrowers with clear and understandable written information about the material terms, costs, and risks of the modified mortgage loan in a timely manner to enable borrowers to make informed decisions.

The order also requires SunTrust to pay $40 million to approximately 48,000 consumers who lost their homes to foreclosure and $10 million to the federal government. The order addresses systemic mortgage servicing misconduct, including robo-signing and illegal foreclosure practices. SunTrust must also pay a $418 million penalty, in a parallel mortgage lending filing announced by DOJ today. Outside of forbearance, you may also be eligible for other relief options, including a payment deferral or loan modification. Additional documentation may be required for applying for these alternative options.

You can temporarily suspend your monthly mortgage payments for an initial period of 3 or 6 months by applying for forbearance. Depending on your financial status and the type of mortgage you have, you may be eligible to have your payments suspended for up to a year or more. You won't be charged penalties or late fees, and your account won't be reported as delinquent to credit agencies during your forbearance. The borrower payment amount will depend on how many borrowers file claims. The agreement'smortgage servicing terms mirror the 2012 National Mortgage Settlement reached in February 2012 between the federal government, 49 state attorneys general, and the five largest national mortgage servicers. You should also check with your state and local government authorities to see if evictions and foreclosures are suspended in your area.

Our compiled list of government relief measures might be a good place to start. Freddie Mac has announced a variety of similar mortgage relief options that are available immediatelyand apply to borrowers who cannot pay their mortgage payments due to a job loss or decline in income resulting from the impact of COVID-19. The agreement's mortgage servicing terms largely emulates the 2012 National Mortgage Settlement reached in February 2012 between the federal government, 49 state attorneys general and the five largest national mortgage servicers. Eligible Utah borrowers whose loans were serviced by SunTrust and who lost their home to foreclosure from January 1, 2008 through December 31, 2013 and encountered servicing abuse will be eligible for a payment from the national $40 million fund for payments to borrowers. Once you reach the end of your forbearance period, you may qualify for additional assistance if you need it. Work with your servicer and, if possible, resume making your regular payments.

If you still need assistance, ask your servicer what other options are available. This could include reducing your monthly payments or some other type ofloan modification. As a homeowner with a federally-backed mortgage loan, you will need to contact your loan servicer to request forbearance. You do not need to submit extensive documentation, mainly only affirmation of your financial hardship, which can be done over the phone. Depending on when your initial forbearance began, you can extend forbearance an additional 180 or even 360 days. The Grant Fund will be administered by an entity chosen by the Government in consultation with SunTrust.

Only tax exempt, non-profit organizations with a valid 26 U.S.C. § SOI certificate may receive grants from the Grant Fund. The Grant Fund administrator may pay its reasonable administrative and programmatic expenses incurred in the administration of the Grant Fund out of the Grant Fund. SunTrust is a mortgage lender and servicer headquartered in Richmond, Va., and is a wholly-owned subsidiary of Atlanta-based SunTrust Banks, Inc. As a mortgage servicer, it is responsible for collecting payments from the mortgage borrower on behalf of the owner of the loan.

It handles customer service, collections, loan modifications, and foreclosures. We are working closely with a number of government agencies, including the VA, FHA, Fannie Mae, Freddie Mac, and USDA, to provide the most current mortgage relief options based on the latest guidelines from the recently passed CARES Act. This includes a foreclosure moratorium of federally backed mortgages for at least 60 days beginning from March 18, 2020.

You can see current sample mortgage rates on the SunTrust website. To get a SunTrust rate quote that's customized to your location, credit score and other factors, you'll have to start the online application process or speak with a loan officer. A loan modification restructures your existing loan's rate or term to change your payments and help you retain your home despite financial difficulties. Modifications can include the repayment amount accrued during your forbearance period and may be paid over your remaining loan term or at maturity. There are different considerations and forms of loan modification, and every situation is different.

Our home preservation team will help you navigate the different options and determine what's best. About 3,200 Virginia borrowers who lost their homes to foreclosure from Jan. 1, 2008, to Dec. 31, 2013, and encountered servicing abuse will be eligible to receive payments from the national fund. Herring's office projects those borrowers could receive up to $2.6 million in those payments.

You may pay a lump sum once the forbearance period ends, spread the amount across the rest of your monthly payments, or tack on payments to the end of your loan term. You can request support on the mortgage homeowners assistance page. If coronavirus has impacted your income, employment or health, mortgage relief options may be available to you. Fannie Mae and Freddie Mac cover about half the home loans in the U.S. If your loan is serviced by one of the major banks or financial institutions, we've got them listed below so you can contact them directly for assistance.